LAS VEGAS, Nev. (FOX5) – Many people would find it quite embarrassing to talk publicly about losing money in a scam, but a Las Vegas Vietnam veteran is sharing his story.

Manny Guerrero lost $180,000 of retirement money to scammers.

“I really felt bad to tell you the truth. I couldn’t sleep. I couldn’t eat. I was losing weight and all kinds of stuff,” said Manny Guerrero.

Guerrero says he wanted to fix up his house with his winnings and give money to his children when he passes. He didn’t tell his kids what he was doing because he wanted to surprise them.

Guerrero’s daughter, Debbie Splane, says they want to talk about the scam, so it doesn’t happen to other people, especially older people.

“It’s devasting that you work all your life, and this man fought for our country, he’s a Vietnam vet, he is so trustworthy, he’s always willing to help people out and this is what happens. But yet, there’s nothing that can be done for him. Not even with the bank. They didn’t care,” Splane said.

Splane says she didn’t know what her dad was doing until she got a call from an FBI agent, who said her dad was being scammed.

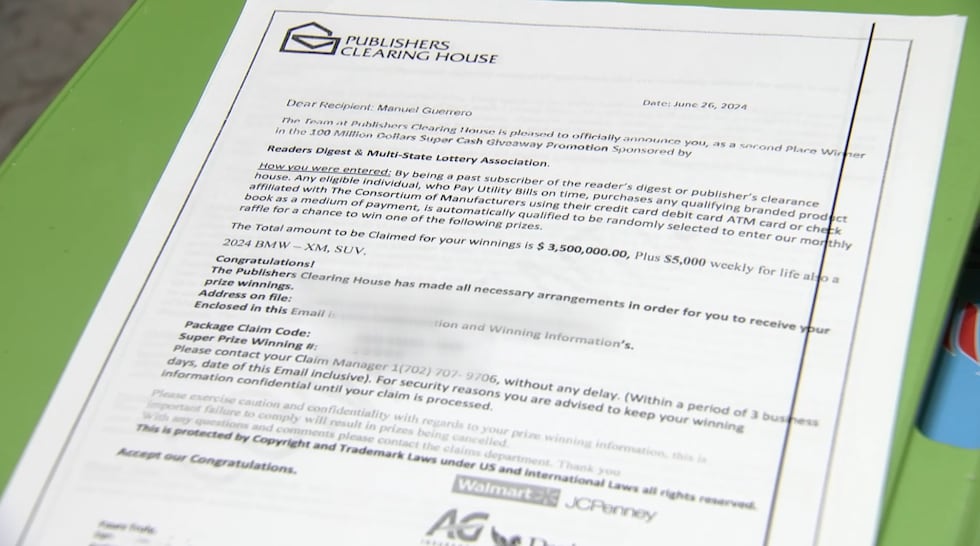

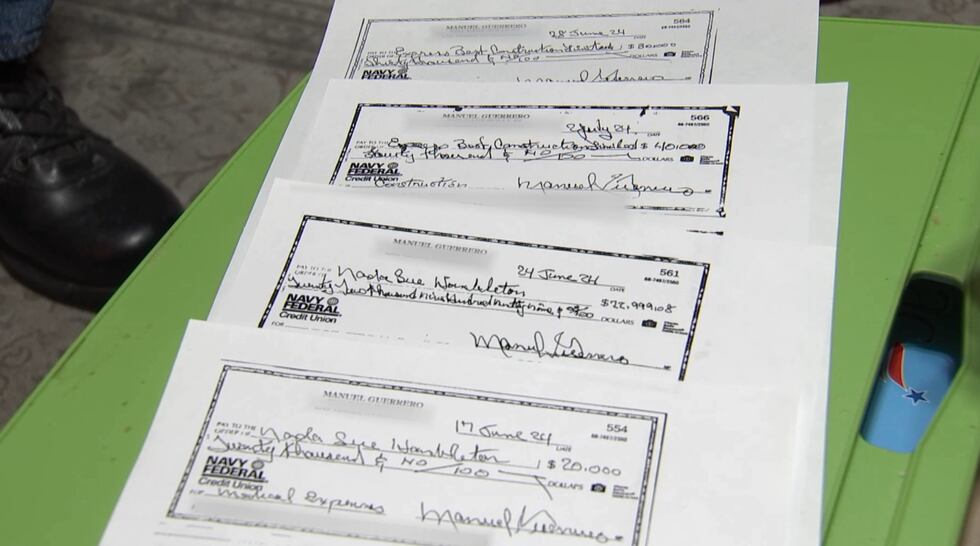

The 89-year-old veteran says he was looking for something to take his mind off the death of his wife in 2008, so he started ordering items from Publishers Clearing House, hoping he could win money by being entered in sweepstakes. He then received a call back in June from someone who claimed to be from Publishers Clearing House, saying he won. That’s when Guerrero started writing checks, some for $22,000, $30,000 and $40,000, along with wire transfers.

“They even asked him, so Manny when we come to your door with the balloons and the check and the car, how would you like it? Would you like it privately or would you like a big hoopla? And my father’s a man of few words, he’s like no, just private,” said Splane.

Splane doesn’t know how someone would know her dad was part of the legitimate Publishers Clearing House back in 2008.

“That’s what’s really strange, I don’t know if there’s some sort of AI system out there where they start collecting all this information,” said Splane.

Splane, who lives in California, says she traveled to Las Vegas after discovering the scam and talked to Navy Federal Credit Union, where she says her dad withdrew the money.

“She said, well it’s your father’s account, he can do whatever he wants. Because I said, ‘Didn’t you see? Didn’t red flags pop up because my father’s withdrawing $25,000, $50,000, $80,000?” They said, ‘No. It’s your father’s money he can do whatever he wants’. But my sister and I were on the account. We were never notified. Never.”

Navy Federal Credit Union Responded to FOX5 with the following statement:

“Unfortunately, we can only discuss or disclose information about account-specific questions and procedures with the member in question. If the member has further questions to discuss with Navy Federal directly, they are always encouraged to call us at 1-888-842-6328 or send us a message online at navyfederal.org via our Online Banking services. Overall, scams can take many forms, often targeting individuals through deceptive communication methods. At Navy Federal we take the privacy and security of our member’s financial information extremely seriously, and as the world’s largest credit union, we regularly work to educate members on how to avoid scams and fraudulent transactions. We also provide security tools to help members protect their accounts such as two factor authentication, code words, and transaction alerts.”

Debbie Splane says some of the checks her dad wrote were to a construction company in New Jersey, which was she says was a phony company.

She also says when her dad asked the scammers for his money back, they agreed, and sent him some checks for more than $200,000. Splane says the FBI told her the checks were from an elderly couple with dementia, who were also scam victims.

Splane gave the checks to the FBI.

To prevent this from happening again, Splane says she’s set up her dad’s account where he can only withdraw a certain amount of money at a time. People can also appoint a trusted contact for accounts. That is someone who the bank can contact about questionable activity.

Splane says while the FBI was working to piece everything together, she says an agent said her dad would be lucky if he got his money back.

Splane says after losing the $180,000, her dad took out a $25,000 loan to pay his bills.

Copyright 2024 KVVU. All rights reserved.