LAS VEGAS (FOX5) — Gerber Life sold nearly two million new “Grow Up Plan” policies last year, according to Bankrate. Many parents and grandparents are buying the policy as a way to put aside money for their kids’ college funds. But some did not understand how the policies were supposed to work.

Eighteen-year-old Las Vegas teen Selma Singer loves Japanese culture and has been taking Japanese for four years in school. She planned to immerse herself in that culture this fall at the University of Tokyo.

Her mom, Karina, tells FOX5 she signed up for the “Grow Up Plan” in 2009 as a way to save up for Selma’s tuition. She said she saw a TV commercial that promised her investment would double when Selma turned 18.

“You thought you would have this safety net for your daughter when she turns 18, college was not going to be a worry for you because you’ve been saving, right?” Victoria asked.

“Exactly,” Karina responded.

Karina said she made her payments every month.

“I just kept paying it no matter what. Even if I couldn’t pay other things, I couldn’t pay rent, I couldn’t pay car, whatever. I made sure to pay that Gerber,” she said. “And now it’s like, I’m sorry. I don’t want to get emotional, but it’s just a lot of stress. It’s a lot.”

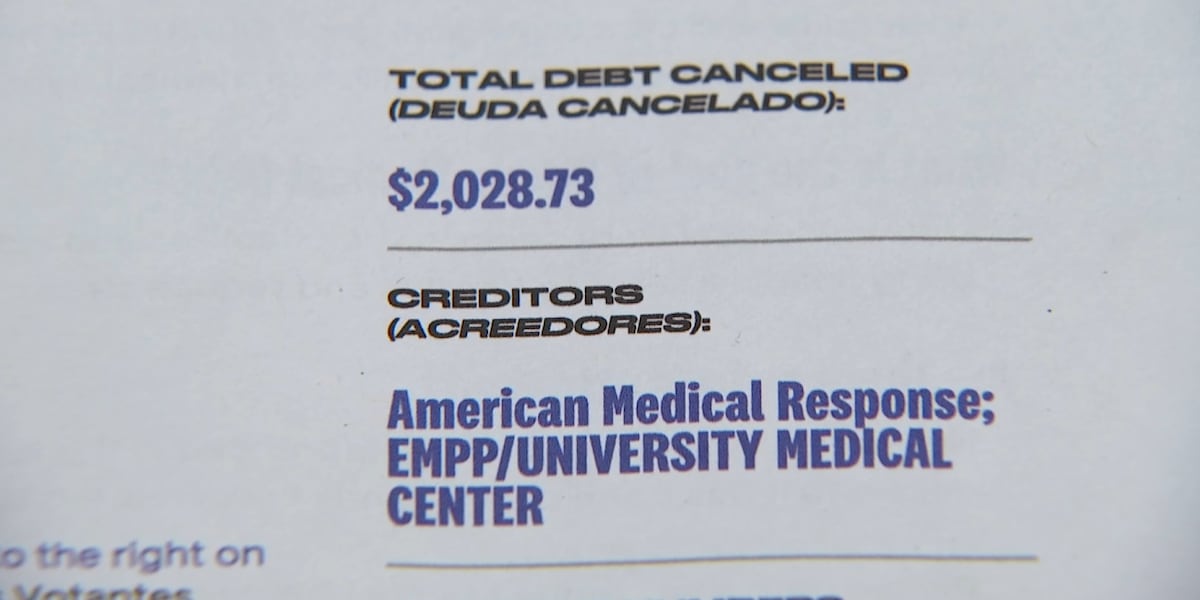

When Selma turned 18, Karina got ready to cash out the policy, expecting to receive the total value of the policy — $50,000 — except that’s not how it works.

While Karina’s policy says “coverage doubles automatically at age 18 while the premium stays the same, guarantees future insurability, cash value that builds over time,” Gerber’s website now says “This money is available for you to borrow against if you ever have the need for ready cash. As an adult, your child will have the option to turn in the policy and receive the available cash value.”

FOX5 Investigates spoke with a consumer attorney who pointed out that parents are buying a whole life insurance policy. That means it will not pay out the advertised benefits until the child dies.

The Grow Up Plan site does point out that the holder can borrow against the policy. But Karina didn’t understand, and now she doesn’t know how she’ll pay for Selma to go to college.

Karina said her daughter’s future is on hold.

FOX5 Investigates learned Karina’s far from the only parent who misunderstood. Gerber Life’s Grow Up Plan and its College Saving Plan face two different class action lawsuits filed by parents and teenagers with similar claims. A suit filed in the Indiana courts claims nearly two million consumers were “intentionally misled by deceptive marketing practices.”

The Nevada Division of Insurance said it received six complaints about Gerber Life plans. Several more complaints were found on the Better Business Bureau website.

Company declines interview, releases statement

FOX5 Investigates reached out to Gerber Life to get a reaction to the lawsuits and complaints. The company declined to come on camera, but released this statement:

“At Gerber Life Insurance Company, we treat all complaints submitted through the Nevada Division of Insurance and the Better Business Bureau with the utmost seriousness. Each matter is promptly reviewed, thoroughly investigated, and addressed with appropriate actions to reach a resolution. We always strive to deliver a positive customer experience. While we appreciate your questions, we cannot comment on the specifics of the pending litigation. We proudly stand behind our products and services – with a long heritage and a trusted legacy – and remain committed to providing reliable protection for families.”

“It’s just really disappointing for you to disappoint your own child, you know, like she was counting on me,” Karina said.

The class action lawsuits are slowly making their way through the court system. In March, a judge denied a request to pause the case while an appeals court reviewed its class action status.

Meanwhile, Karina said her daughter had to take a gap year and put her Tokyo dreams on hold, but is determined to save up in hopes of going next year.

Copyright 2025 KVVU. All rights reserved.